charity expenses policy|How to Craft the Perfect Nonprofit Reimbursement : Cebu Learn about the law and good practice for charities that want to pay or reimburse their trustees or connected persons. Find out when and how to get authority .

ユーロテル マカティ ホテル (Eurotel Makati Hotel) . でも、私がagodaからの予約客だと. さらに表示. JUNYA, 日本. Ascott Makati. 8.8 非常に満足. クチコミ全4586件の総評. 年々宿泊代が上がっていっているのが心配ですが、毎回利用させて頂いております。私的に .

PH0 · Trustee expenses and payments

PH1 · TRUSTEES EXPENSES POLICY

PH2 · Staff and Personnel Expenses Policy

PH3 · Reimbursement of Expenses & Purchases

PH4 · Managing charity finances

PH5 · How to Craft the Perfect Nonprofit Reimbursement

PH6 · Expenses policy V5

PH7 · Expenses Policy

PH8 · 2020 Guidelines for a Nonprofit Reimbursement Policy

Top 100 Highest Overall Earnings. This list represents the top 100 players in esports who won the most prize money based on information published on the internet. Sources include news articles, forum posts, live report threads, interviews, official statements, reliable databases, VODs and other publicly-accessable sources that preserve .

charity expenses policy*******Staff and Personnel Expenses Policy. Approval Status: . Version 1.1 of the policy approved by the Renewable World Board on 20th November 2018. Introduction: ir duties on behalf .The purpose of the expenses policy is to provide Sightsavers staff with clear guidance on the organisation’s position on the validity of expenses, the procedures for making an .

The purpose of this policy is to ensure that all expenses incurred by employees, Trustees and volunteers working on NSPCC business comply with the NSPCC’s expenses rules .Policies & Procedures. Applicability. All Trustees, Members, Staff, Associates and Volunteers are entitled to be reimbursed for out-of-pocket expenses which they .Ordinary expenses related to the business of your nonprofit can include: Lodging. Travel expenses. Dining expenses. Cost of hosting events. Cost of rent for office space. Utility . Learn about the law and good practice for charities that want to pay or reimburse their trustees or connected persons. Find out when and how to get authority . Your charity should have a written policy setting out what is classed as an expense and how to claim and approve expenses.Key facts. This policy applies to all staff, volunteers, casual workers, and anyone incurring out of pocket expenses wholly, necessarily, and exclusively in connection with . 1. Have an accountable plan for regular reimbursements. Nonprofits expecting to regularly reimburse staff or volunteers should have an accountable plan. According to the IRS, you must follow several .This policy provides information for anyone travelling on College business in the UK and Ireland who wishes to claim travel expenses from the RCOG. This policy was approved by the Finance & General Purposes Committee on 20 May 2022. For travel outside the UK and Ireland, see Travel and Expenses Policy – Global. 1. Introduction.

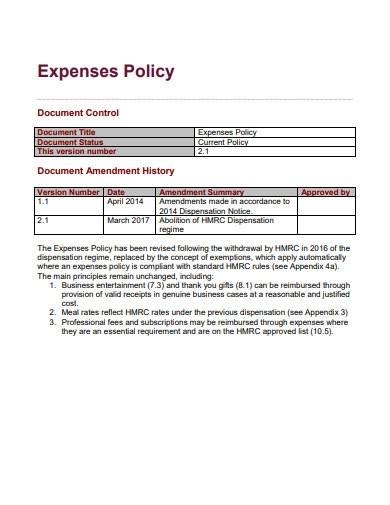

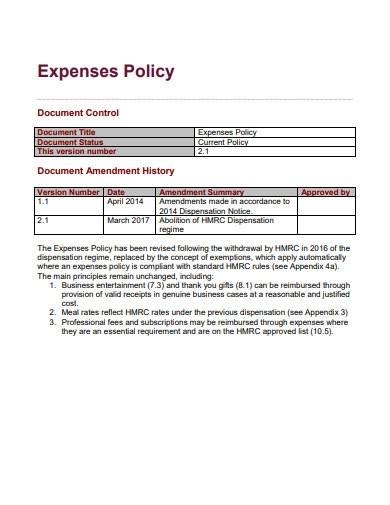

40+ free sample charity policy templates and advice on the policies a charity should have, as required by UK Law & the Charity Commission. . Leave entitlement, travel expenses and pay policies are worth thinking about, as are a flexible working and a working from home policies.Incorporated under Royal Charter Registered Charity Nos. 207544 & SC038110 Royal Commonwealth Society for the Blind Expenses Policy . Document Control . Document Title Expenses Policy . The Expenses Policy has been revised following the withdrawal by HMRC in 2016 of the dispensation regime, replaced by the concept of exemptions, .

The following items are not reimbursable under this policy: -Parking fine tickets. -Speeding tickets. -Finance charges for personal credit card. -Excess baggage charges. -Expenses for travel incurred by companion/family members. -Expenses related to holiday or non-charity related activities whilst on a charity trip. 2. Trustee expenses. The total amount of expenses, if any, paid to charity trustees and the number of charity trustees receiving expenses. You must also state if no expenses were paid to charity trustees. 3. Transactions with trustees and connected persons. The nature of any transactions between the charity and any charity trustee or .Share your volunteer expenses policy with new volunteers when they join your organisation. It could form part of their volunteer induction. . Registered in England as a charitable company limited by guarantee. Society Building, 8 All Saints Street, London N1 9RL. Registered company number 198344 | Registered charity number 225922.The current mileage allowance payments are: For cars and vans, 45p per mile for the first 10,000 miles and 25p per mile for every mile over 10,000. Motorcycles, 24p per mile. For bicycles, 20p per mile. You can also pay an additional 5p per mile for every passenger. Charity travel expenses: subsistence.The policies and procedures contained in this document are intended to be adapted and tailored to your specific organisation. Obvious slots exist for you to drop in your organisation name, or the job title of the relevant person, but it’s important to read through the policies fully before deciding whether further changes are required!

Sample conflict of interest policy. Sample conflict of interest policy, declaration form and register of interests for trustees. . Sample trustee expenses claim form. Organisational management calendar. A sample management calendar for users to adapt for their own organisations. Risk register. A template risk register is a framework for .charity expenses policyTrustee Expenses Policy. The concept of unpaid trusteeship has been one of the defining characteristics of the charitable sector, contributing greatly to public confidence in charities. Individual Trustees should not be deterred from playing their full part because of incidental costs and trustees are entitled to have their expenses met from .Charity Trustees Expenses Policy is part of Corporate Documents. Just £35.00 + VAT provides unlimited downloads from Corporate Documents for 1 year. Download. Template for use by a charity which wishes to adopt a policy about reimbursement, by the charity, of expenses incurred by its trustees.charity expenses policy How to Craft the Perfect Nonprofit Reimbursement Search guidance for charities by topic: Charity boards and governance. Trustees, staff and volunteers. Money, assets and property. Your charity’s activities. Fundraising. Accounts, financial .NCVO and ACEVO call for all charity roles to be advertised as flexible. The voluntary sector needs to lead the way on flexible working and advertise all roles as flexible, with employers encouraging open conversations about how it can work in their organisation. Employing and managing staff. News and updates. 10 February, 2022.How to Craft the Perfect Nonprofit Reimbursement 2.1.1 Expenditure (purchase and payments) 17 2.1.2 Wages and salaries 18 2.1.3 Travel and subsistence expenses 20 2.1.4 Debit card/credit card payments 22 3. . Does the charity have a pricing policy for the goods and services supplied? b) Does the charity have invoicing procedures for the goods and services It would be entitled to tax exemption on those sources of attributable income, totalling £30,400. The charity also has other non-taxable grant income of £1,600. The charity spends £10,000 on .

13.2.1 All expenses are to be claimed for by submitting a volunteer expenses form, which can be obtained from the relevant BHF Manager. All claims must be accompanied by the appropriate receipts. 13.2.2 Expenses must be adequately described on the expenses form and failure to do so may result in non-payment.

The charitable spending ratio is 90% (£900 spent on charitable activity as a proportion of £1,000 total spending). The next year the charity decides to spend £300 running a fundraising event that generates £500 of income, a profit of £200. Its total income is now £1,500 (£1,000 donations + £500 from the event) and it spent £400 in .The charitable spending ratio is 90% (£900 spent on charitable activity as a proportion of £1,000 total spending). The next year the charity decides to spend £300 running a fundraising event that generates £500 of income, a profit of £200. Its total income is now £1,500 (£1,000 donations + £500 from the event) and it spent £400 in . If your charity pays expenses, you should have a policy that sets out the rules. It should include how to make a claim and what evidence you need to submit. You should make sure that:

Welcome to Wrestling Inc.'s live coverage of Monday Night RAW live from the XL Center in Hartford, CT! With WWE Backlash behind them, the Superstars will set their sights on the King and Queen of .

charity expenses policy|How to Craft the Perfect Nonprofit Reimbursement